Tilting the Odds in Your Favor

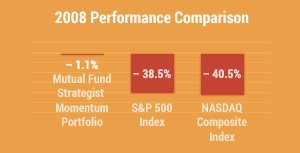

We take an active approach to managing stock market risk by employing sensible timing strategies with mutual funds, ETFs and market indexes. When our time-tested indicators begin flashing warning signs, we advise you to switch your investments into the safe haven of a money market fund until the odds of making money are once again in your favor. We’re here for you, 52 issues per year, with frequent hotlines between newsletters.

One Newsletter, So Many Tools

If you need strong direction, follow our model portfolios. Designed for investors with varying degrees of risk tolerance, our Aggressive, Moderate and Conservative Portfolios take the guesswork out of the investment process by telling you exactly which funds to buy and when to sell them.

Stay Connected with Weekly Issues

Looking for general guidance? Take advantage of our many timing models. We provide buy and sell signals for both intermediate-term and long-term trends for the Dow, S&P 400,S&P 500, Nasdaq, Nasdaq 100, NYSE, Russell 2000, Wilshire 5000, US Equity Funds, US Bond Funds, US High Yield Bond Funds, US Municipal Bond Funds, International Equity Funds, International Bond Funds, Asia Funds, Europe Funds, Japan Funds, Latin America Funds and Gold Funds.

You can combine timing model buy signals with top funds from our weekly relative strength rankings. Each issue ranks funds by momentum in categories corresponding to our timing models - plus bonus lists for DireXion, Fidelity, ProFunds, Rydex and Vanguard funds.

Low-Risk Subscription

Not sure this is the right newsletter for you? Subscribe month to month with our $17.00 auto-renew program. Cancel at any time.